Our contribution to local vitality

The presence of CDA subsidiaries in the region generates direct employment, many of them seasonal and local. Subsidiaries also generate indirect and induced employment through their own purchases, payments to local authorities, and the transmission of these expenses into the local or regional economy.

A special study, carried out by BDO, quantified the multiplier effect of our activities, taking into account the type of purchases we make, the payroll we pay and the repayments we make in the form of taxes, royalties and fees.

This new exercise, carried out over the 21-22 financial year and across the entire scope of our activities in France, complements other exercises carried out over an initial scope in 2016 on six Ski Areas and Futuroscope Park, then extended to include Parc Astérix in 2019.

It aims to illustrate the economic impact of our activities and policies on the local area at different levels (Département, Region, Pays).

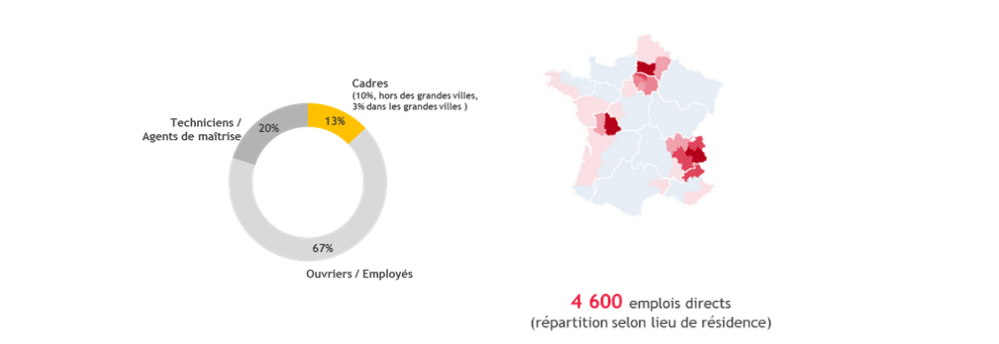

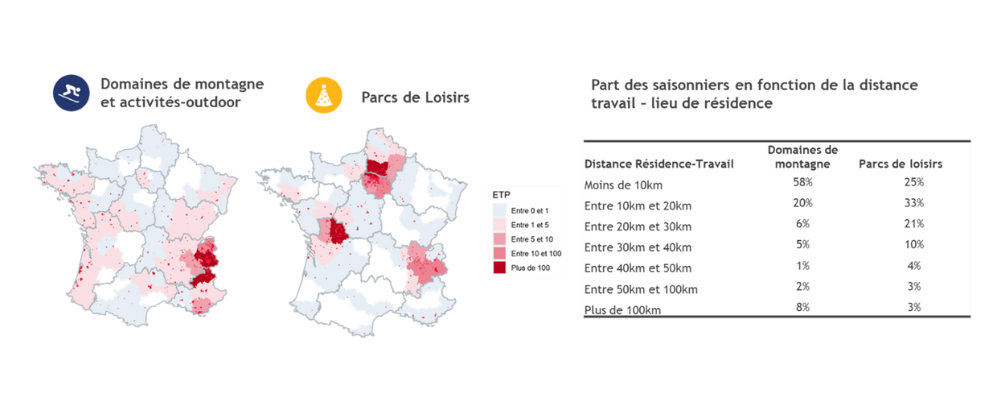

A wide range of job opportunities in the immediate vicinity of the Group's leisure sites

The Group offers local employment opportunities at all skill levels, with 10% of executive-level jobs located outside major French cities.

Seasonal jobs, with an average duration of 3.1 months (including 4.5 months in the mountains), are mostly filled by local seasonal workers: 80% have their main residence less than 30 km from the workplace.

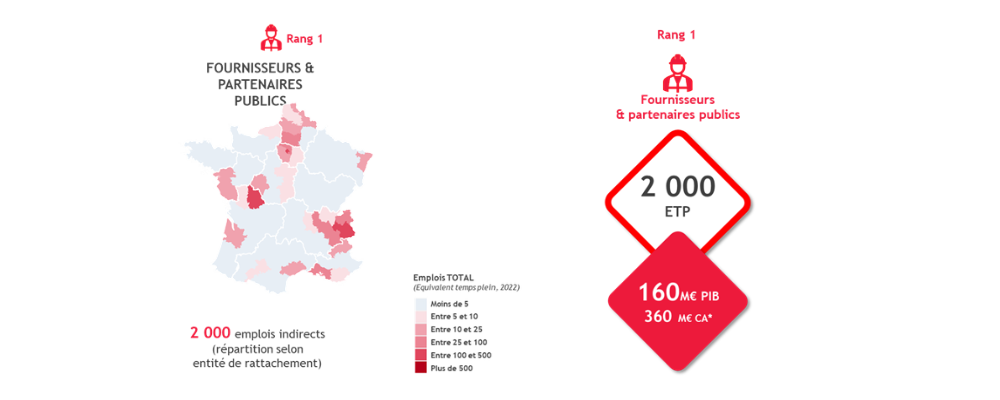

The economic stimulus provided by purchasing from suppliers is spread throughout France, with a predominant effect in the regions where CDA sites are located.

. 2,000 indirect jobs are created in France with Tier 1 suppliers (or €160 million contribution to GDP), with a predominant effect near our sites ;

. 95% of Opex and Capex spending is with suppliers based in France ;

. Purchasing expenditure irrigates a dense industrial fabric made up of over 5,000 suppliers of all sizes:

200K€ on average spent with 350 major companies

€130K on average spent with 720 mid-sized companies

40K€ on average spent with 3,910 VSE/SME.

The economic impact is predominant in the local value chain: in fact, 59% of the indirect contribution to France's GDP by tier 1 suppliers is located in 4 regions :

- Auvergne-Rhône-Alpes

- Provence Alpes Côtes d’Azur

- Nouvelle Aquitaine

- Hauts-de-France.

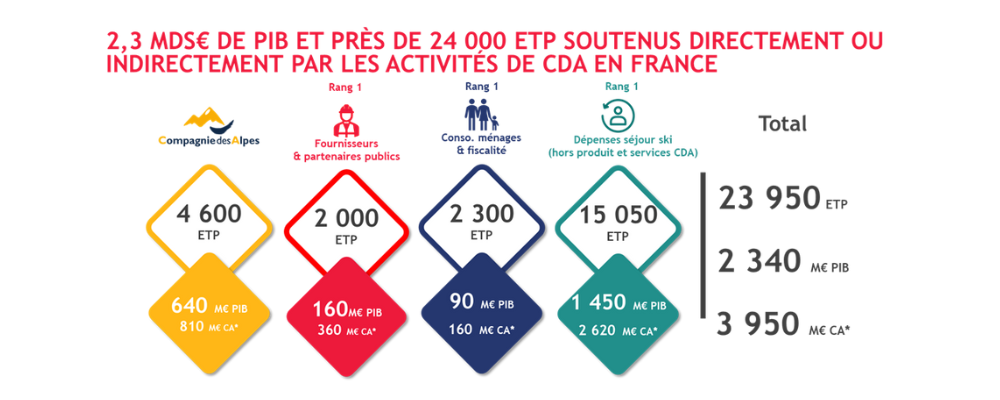

Overall, the economic and social responsibility of Compagnie des Alpes in France amounts to 24k jobs (in FTE) and 2.3 billion in wealth (GDP) in 2022.

The contribution to GDP, i.e. to the wealth created by CDA's activity in France, represents €2.3 billion

890 M€ through value creation and financial flows :

640 M€ in direct added value

160M€ of wealth diffused through spending with Tier 1 suppliers

90 M€ in wages paid to employees, taxes paid to local authorities

or by geographical breakdown :

470 M€ in the Rhône-Alpes

130 M€ in Hauts-de-France,

93 M€ in Nouvelle-Aquitaine

1450 M€ of wealth is created by visitor spending, excluding products and services sold by CDA, during their ski stay (data not available for leisure parks).

Our facilities are real tourist attractions, generating nearly 22.3 million visits to the region in 2021 / 2022. Their activity thus benefits shops, transport, accommodation and catering activities, and other socio-economic players in the wider tourism ecosystem.

All these flows contribute to around 24k jobs in France: each CDA job therefore generates more than 4 other jobs in France.

Excluding the catalytic contribution (ski trip expenditure excluding products and services sold by CDA), all these flows contribute to around 9k jobs in France, 75% of which are spread across four regions

- Auvergne-Rhône-Alpes (2 750),

- Hauts-de-France (1 450),

- Île-de-France (1 250)

- Nouvelle-Aquitaine (1 200).

Contributing to the reputation of France as a European destination

Through the quality of their facilities and services, these resorts contribute to the reputation of France as a tourist destination, both nationally and in Europe. Based on a survey focusing on overnight stays in professional beds over the 2018 / 2019 season, French and Europeans from 10 neighboring countries accounted for over 93% of professional overnight stays in mountain resorts.

Leisure parks have more of a regional or national clientele.